Securing the Fund With Bitcoin

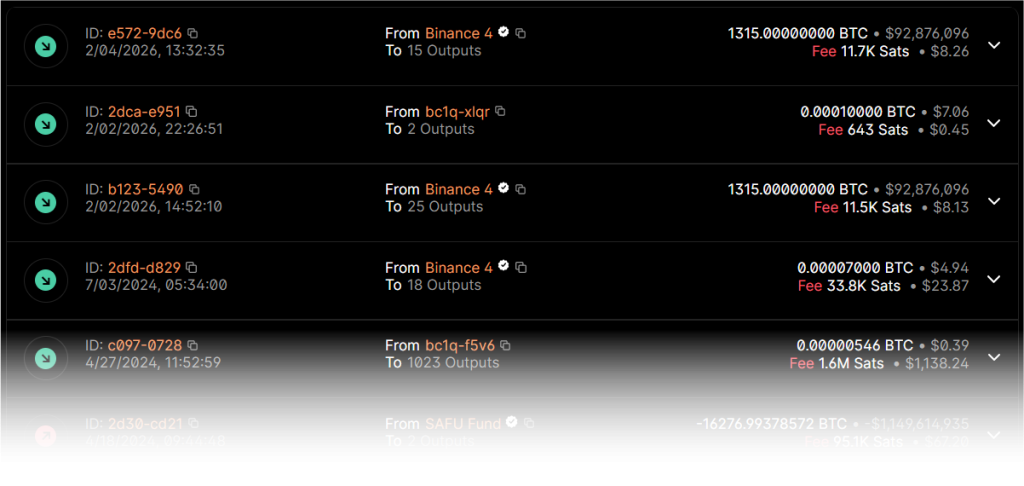

SAFU moved its reserves into Bitcoin because BTC has no issuer risk, stays liquid during market crashes, and can’t be frozen or de-pegged. For an emergency fund owned by Binance, Bitcoin is the most reliable asset when conditions turn extreme.

Why SAFU Shifted Its Reserves to Bitcoin

SAFU gradually reallocated its reserves into Bitcoin because Bitcoin performs differently during

systemic stress. Not in price — but in function.

Bitcoin offers:

Trustless

No issuer or counterparty risk. Pure code execution without intermediaries.

Global Liquidity

Instant liquidity everywhere, even during panic. The market never sleeps.

Always On

A network that continues to operate when markets are chaotic and servers fail.